Content

- Cost Of Goods Manufactured Template

- Cost Of Goods Manufactured Example

- Work In Process Inventory Wip: Definition, Formula & Examples

- Relevance And Use Of Cost Of Goods Manufactured Formula

- Total Manufacturing Cost Formula: Metrics That Matter

- Chapter 1: Nature Of Managerial Accounting And Costs

- Why Is The Finished Goods Inventory Formula Useful?

For example, rent for a factory building and depreciation on equipment are considered manufacturing overhead costs. Prime CostPrime cost is the direct cost incurred in manufacturing a product and typically includes the direct production cost of goods, raw material and direct labour costs. Costing and effective pricing of the goods are primarily determined on their basis.

- Finished Goods Inventory, as the name suggests, contains any products, goods, or services that are fully ready to be delivered to customers in final form.

- Also, do not forget that there could be raw material purchases in the meantime.

- Knowing how to accurately calculate WIP inventory can impact your balance sheet.

- To calculate the cost of goods manufactured, you must insert your direct materials, direct labor, and manufacturing overhead into a formula.

- This is not to be confused with the cost of goods manufactured , which refers to just the cost of inventory that was finished and prepared for the sale in the period.

Only after the cost of goods manufactured is calculated can a company now compute its cost of goods sold. After calculating the costs of goods manufactured, the COGM value moves into the final inventory account called the Finished Goods Inventory account.

Cost Of Goods Manufactured Template

Learn about the definition and types of external environments, including micro and macro environments, and explore the factors of each that affect a business. For the finished goods amounts refer to the section where we talked about the finished goods. For the selling and administrative expenses refer to the section where we discussed the selling and administrative expenses (i.e., nonmanufacturing or period costs). The most likely reason for differences between the costs of goods manufactured and sold is simply that the mix of products sold does not exactly match the mix of products manufactured. There may be lots of sales during the month from inventoried reserves, while there is no manufacturing going on at all.

- The COGM formula examines the expenses related to producing finished goods, in terms of labor, materials, and other variables.

- A high manufacturing overhead rate indicates that the company’s manufacturing operations may not be utilizing the resources available as efficiently as they should.

- In other words, the cost of goods manufactured falls under the cost of goods sold in an income statement.

- All your products, customers, orders and transactions synced and secure in the cloud.

- You can even start selling your products on an online marketplace with confidence.

You may find that a just in time inventory setup or a vendor managed inventory agreement make sense after looking at the data. Cost of Goods Manufactured may be a term employed in managerial accounting that refers to a schedule or statement that shows the full production costs for a company during a particular period of your time. Rather like the name implies, COGM is that the total cost incurred to manufacture products and transfer them into finished goods inventory for retail sale. Manufacturing overhead is all costs tied to your organization’s manufacturing operations. These are the ancillary costs in addition to direct materials and labor, and they all must be listed under the cost of goods sold on a financial statement. Accountants within your company have to note the overhead cost for each unit created by your production team, while property taxes and insurance costs also need to be considered.

Cost Of Goods Manufactured Example

The Finished Goods Inventory is the difference between the beginning finished goods inventory and the ending finished goods inventory. Therefore, 10% of Ben’s monthly revenue will go toward servicing the company’s overhead costs. A high manufacturing overhead rate indicates that the company’s manufacturing cogm formula operations may not be utilizing the resources available as efficiently as they should. On the other hand, a low manufacturing overhead rate points towards effective and efficient use of resources. To calculate the manufacturing overhead, a company first has to know its manufacturing overhead costs.

It is more simple to find it compared to direct materials; hours rates are generally fixed and with the information of how many hours are worked in total, the direct labor cost is easily calculated. The finished goods formula is useful because it helps business owners better understand the value of their inventory, and record that value as an asset on their balance sheet. Finished goods inventory is the total number of manufactured products that are available, in stock, and ready for purchase by the consumer. With that said, finished products are often a relative concept, since a seller’s goods may actually become another buyer’s raw materials inventory. Still, finished goods are an important inventory management metric, and the formula is helpful when determining the valuation of the goods for sale.

Dummies helps everyone be more knowledgeable and confident in applying what they know. Therefore, the cost of goods manufactured incurred by ZXC Inc. during the year 2018 was $43.35 million. Therefore, the cost of goods manufactured by SDF Ltd. during the period was $5.30 million. The cost of goods manufactured is how much the company spends to produce the goods. In this article, we explore how to calculate your COGM with examples, why COGM is important and answers to common questions. It shall help in setting out with appropriate classification of the elements of the costs in detail. Hence, the cost of goods manufactured will be 13,66,47,400 and per unit, it will be 1,366,474 when divide it by 100.

The cost of products sold is the only time product expenses are expensed, and it is presented as an expense on the income statement. Total manufacturing costs showcase how much your company spent to produce its inventory in a given period of time. This includes a thorough account of the cost of overhead, materials used, labor, and any other manufacturing expenses that contributed to completing the product. This is not to be confused with the cost of goods manufactured , which refers to just the cost of inventory that was finished and prepared for the sale in the period. Rather, total manufacturing costs include all related costs accrued in the period.

Work In Process Inventory Wip: Definition, Formula & Examples

Check inventory records to find out the finished goods inventory for the previous period. To help you better understand how to determine current WIP inventory in production, here are some examples. The cost of goods manufactured is an essential component that provides a clear picture to business owners and managers about the company’s manufacturing performance. In production, costs are luckily suitable to calculate in mathematical ways.

The cost of goods sold may therefore be substantial, while the cost of goods manufactured is zero. Taking the time to better understand WIP inventory can give you a deeper understanding of your supply chain management, which means better optimization and more revenue.

Relevance And Use Of Cost Of Goods Manufactured Formula

Manufacturing overhead is a part of the COGM formula; more specifically one of the components in the total manufacturing cost part. However, what should we include into manufacturing overhead is a complicated matter and doesn’t have a certain answer. Costing is the business function of collating and apportioning expenditures so as to determine costs of products, processes or functions. Costing has several purposes including inventory valuation, determination of selling prices, cost control as well as assisting management in decision making. Two important costs which are derived as a result of costing function are cost of goods manufactured and cost of goods sold . These costs assume importance in determining gross profitability of an entity.

The components of the total manufacturing costs include the direct materials costs, the direct labor costs, and the assigned overhead costs during the accounting period. The cost of goods manufactured is a calculation of the production costs of the goods that were completed during an accounting period. The cost of goods manufactured schedule is used to calculate the cost of producing products for a period of time.

There are some very short or simple manufacturing processes that don’t require specific reporting of WIP inventory. In those instances, companies move straight from raw materials inventory to finished goods inventory.

The COGM formula takes into account all expenses related to the manufacturing of inventory including direct materials, factory overhead and labor expenses. The costs of goods manufactured may also be referred to as the cost of goods completed. The schedule reports the total manufacturing costs for the period that were added to the work‐in‐process .

Total Manufacturing Cost Formula: Metrics That Matter

Let’s say your starting inventory is $3,481, your cost of goods manufactured is $5,000, and your cost of goods sold is $2,090. Inventory is frequently a manufacturer’s largest profit driver and current asset. An accurate tally of current assets makes future operating budgets and financial budgets accurate. So, Calculate the cost of goods manufactured incurred by the company during the year on the basis of the given information. Explore eight tips for finding career fulfillment you can use, including finding a job that aligns with your values and creating a personal mission statement. And are in force, then it may also help them in fixing the amount of production along with profit-sharing bonuses.

Put simply, ERP software allows you to reduce the use of unnecessary resources without sacrificing quality. The finished goods inventory formula is fairly straightforward, but it does require you to know your cost of goods manufactured , as well as your costs of goods sold .

Raw materials are stockpiled items that will be employed in the manufacturing of finished goods. For a certain time period, moreover, direct labor refers to how much was paid in labor costs. This is usually so simple to compute and can be done by multiplying the number of hours worked by each employee’s hourly wage.

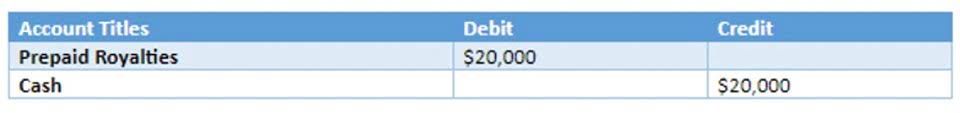

To speak to an expert about how to automate your accounting, request a quick demonstration of ScaleFactor’s accounting and finance software here. The cost of goods manufactured total is also a component of thecost of goods sold calculation. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. Direct material purchases included $2,000 of paint and $7,000 of plastic and metal parts. The cost of goods sold may contain charges related to obsolete inventory.

By maximizing these seven types of wastes, companies can efficiently reduce the cost of goods manufactured and run an efficient and more productive manufacturing process. Since COGM only accounts for finished products the company has for sale or has sold, it is an excellent KPI for gauging the profitability of a company. In other words, the cost of goods manufactured falls under the cost of goods sold in an income statement. It is an integral component for determining and calculating the cost of goods sold . The three primary components that make up the total manufacturing cost of any business have multiple equations within.

Shipping cost is a part of COGS, but paying the transportation of the purchasing product will be included under the cost of goods purchased. The key point is to decide whether these costs are incurred on a manufacturing specific basis. Electricity and gas are normally fixed costs and monthly expenses just like rent. However; they become manufacturing overhead costs if they are allocated to the units manufactured. Now we can go deeper and find out how to calculate the cost of goods manufactured. The COGM formula is basically formed as calculating the total manufacturing costs, adding the beginning WIP (work-in-process) inventory and subtracting the ending WIP inventory from this sum.

But, as a rule, you want to minimize finished goods inventory to keep storage costs down. The point here is getting familiar enough with your finished goods inventory level that you can draw actually useful conclusions from it. Finished goods inventory is reported on the balance sheet as a current asset. That means they’re short-term assets meant to generate revenue within the next 12 months. The cost of goods manufactured formula shows ABC Furniture Store was able to complete and put up for sale $160,000 worth of furniture from the work in process inventory during the year.

Finally, you need to know how to calculate total manufacturing overhead. This is everything else you need to keep your production running, which is a bit more indirect. Overhead expenses can really impact your balance sheet and income statement, so you need to track these costs. Knowing your firm overhead means you can budget the money needed to cover these costs. Rent cost for instance is under the overhead cost only if it is the rent of manufacturing facilities.

The COGM amount is transferred to the finished goods inventory account during the period and is used in calculating cost of goods sold on the income statement. Evaluating the cost of finished goods plays a big role in the success of your business.

Business owners use several tools to help determine the overall profitability of their company, one of which is the cost of goods manufactured . The COGM formula allows you to get a better idea of overall production costs and how these costs are impacting the company’s bottom line. Enterprise Resource Planning system is software that can help you manage all of the core supply chain, manufacturing, services, financial and other processes related to your organization. It can be used to help you simplify, plan, budget, automate and accurately report on your operations.

Why Is The Finished Goods Inventory Formula Useful?

One business aspect every manufacturer has to understand, track, and interpret is the Cost of Goods Sold . Unlike retailers, manufacturers have more inventory categories such as finished goods, work in process, and raw materials which all contribute to the cost of goods manufactured. Cost of goods sold is the cost of selling products, in other words the cost of finished inventory ready for sale.

Author: David Paschall